massachusetts estate tax table

Up to 25 cash back If you were to translate the amount owed into a tax rate on the portion of the estate that exceeds the Massachusetts exemption amount of 1 million the top rate would be 16that is you would not be taxed more than 16. There is no Massachusetts gift tax and there is a 16000 annual exclusion amount for Federal gift tax purposes.

Massachusetts Estate Tax Everything You Need To Know Smartasset

If you are married then you can do up to 32000 per year 16000 each or.

. This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed. 20 provision - the Massachusetts estate tax liability will not be greater than 20 of the amount of the Massachusetts net estate that exceeds 200000. When we add that number 20480 to the base taxes 522800 we get a total Massachusetts estate tax of 543280 owed on a 62 million estate.

Reproduction of Tax Forms. Secure websites use HTTPS certificate lock icon https means youve safely connected the official website. Massachusetts uses a graduated tax rate which ranges between 08 and a maximum of 16.

This means you can shift up to 16000 to each person in your family each year without paying a gift tax and without worrying about estate tax implications. If that threshold had simply been adjusted for inflation it would now be more than 14 million but this adjustment does not accurately reflect the growth in residential real estate values typically the largest asset of a homeowners estate. An estate valued at 1 million will pay about 36500.

The estate tax is a transfer tax on the value of the decedents TAXABLE estate before distribution to any beneficiary. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. The bottom of the threshold is 6040 million so we subtract that from 62 million and get 160000.

If the value of the Massachusetts taxable estate exceeds the exclusion amount the estate tax is calculated using the table found in MGL. How you know Official websites use massgov massgov website belongs official government organization Massachusetts. Massachusetts Estate Tax Table 2017.

Masuzi July 19 2018 Uncategorized Leave a comment 8 Views. Your estate will only attract the 0 tax rate if its valued at 40000 and below. A properly crafted estate plan may significantly reduce potential estate tax liabilities.

The filing threshold for 2022 is 12060000. 3 900000 - 60000 840000. Search Mass Estate Tax Rate Table.

5 The term adjusted taxable estate means the taxable estate reduced by 60000 per Internal Revenue Code 2011b. Determine the gross estate see The Gross Estate. Masuzi March 3 2018 Uncategorized Leave a comment 52 Views.

This means that if your estate is worth 25 million the tax will apply to the entire 25 million not just the 15 million amount that is above the exemption. Unlike most estate taxes the Massachusetts tax is applied to the entire estate not just any amount that exceeds the exemption threshold. 65C 2 a and see Tax Table.

The graduated tax rates are capped at 16. Ad Search Mass Estate Tax Rate Table. For estates of decedents dying in 2006 or after the applicable exclusion amount is 1000000.

The Leading Online Publisher of National and State-specific Wills Legal Documents. Assumptions Assets in Your Name Your Liabilities Life Insurance on Your Life Charitable Bequests from Your Estate. We dont make judgments or prescribe specific policies.

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Massachusetts state estate tax law key 2020 wealth transfer tax numbers moved south but still taxed up north mass estate tax 2019 worst.

Compare these rates to the current federal rate of 40 Deadlines for Filing the Massachusetts Estate Tax Return. Under the table the tax on 840000 is 27600. Future changes to the federal estate law will not affect the Massachusetts estate tax law as the reference for Massachusetts is the Code as in effect on December 31 2000.

Killing estate ta estate ta or inheritance tax debate massachusetts estate and gift ta. That amount multiplied by the marginal rate of 128 is 20480. The Massachusetts estate tax threshold has been set at 1 million since 2006.

625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or before the 20th day following the close of the tax period. Get Results On Find Info. Unless specifically stated this calculator does not estimate separate estate or inheritance taxes which are levied in many states.

A local option for cities or towns. A guide to estate taxes Mass Department of Revenue The adjusted taxable estate used in determining the allowable credit for state death taxes in the table is the federal taxable estate total federal gross estate minus allowable federal deductions less 60000. A state sales tax.

Massachusetts Estate Tax Table. To summarize the steps to calculate the Massachusetts state estate tax are as follows. Future changes to the federal estate tax law have no impact on the Massachusetts estate tax.

Tax Forms All estate tax forms are available on DORs website at wwwmassgovdor or by calling 617 887-6930. 4 1900000 - 60000 1840000 - 1540000 300000 x 72 21600 70800 92400. See what makes us different.

Why More States Are Killing Estate Ta Familywealth 17. The rate ranges from 8 to 16. A state excise tax.

Massachusetts Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How Do State Estate And Inheritance Taxes Work Tax Policy Center

What Is An Estate Tax Napkin Finance

Focus Shifts To State Estate Tax Planning Wsj

Eight Things You Need To Know About The Death Tax Before You Die

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

State Corporate Income Tax Rates And Brackets Tax Foundation

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

Massachusetts Estate And Gift Taxes Explained Wealth Management

Death Tax Definition Qualification Example How To Reduce

A Guide To Estate Taxes Mass Gov

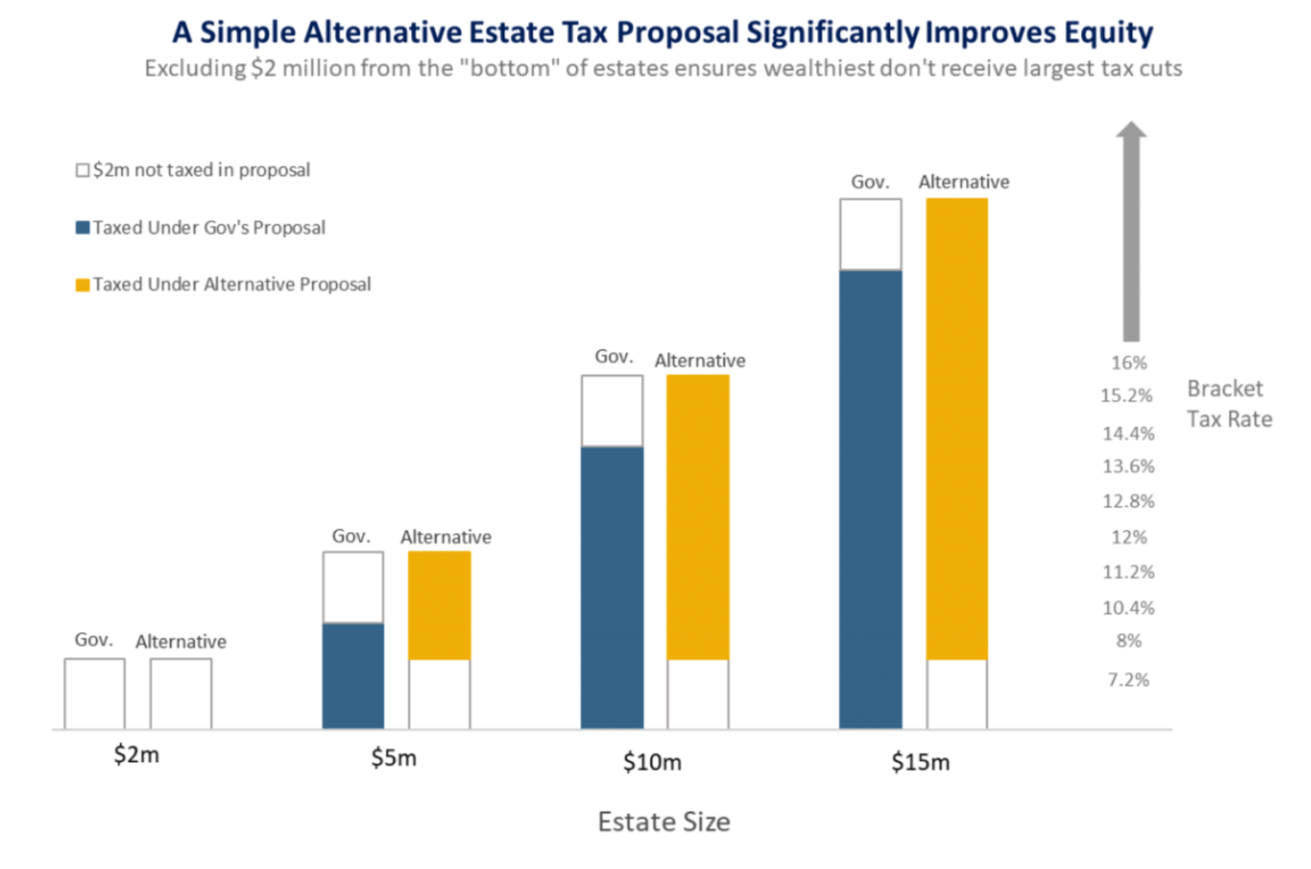

Current Estate Tax Proposals Would Give Largest Benefits To Wealthiest Estates Alternative Method Would Fix This Problem Mass Budget And Policy Center

What Are Estate And Gift Taxes And How Do They Work

Massachusetts Estate Tax Everything You Need To Know Smartasset

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)